Protection through insurance indemnifies a business for their own loss but also pays for expensive litigation. Without insurance, a small-to-medium enterprise (SME) cannot survive the loss resulting from an adverse, sometimes catastrophic, event.

Legal advice helps you identify the icebergs – Insurance is the protection you need against what lies below the surface.

We can help tailor an insurance package specifically for your business.

2.5M

No of SMEs in Australia

>50%

305,085

No of SMEs exit

Reputed insurance companies we partner with to protect your business:

Director, Meena Wahi, has your back. With more than 20 years’ risk management experience, she heads our insurance division. MBA educated and a member of the Australian Institute of Company Directors, her background includes management consulting for PwC, and serving the Bendigo Bank Community Branch as a Board member.

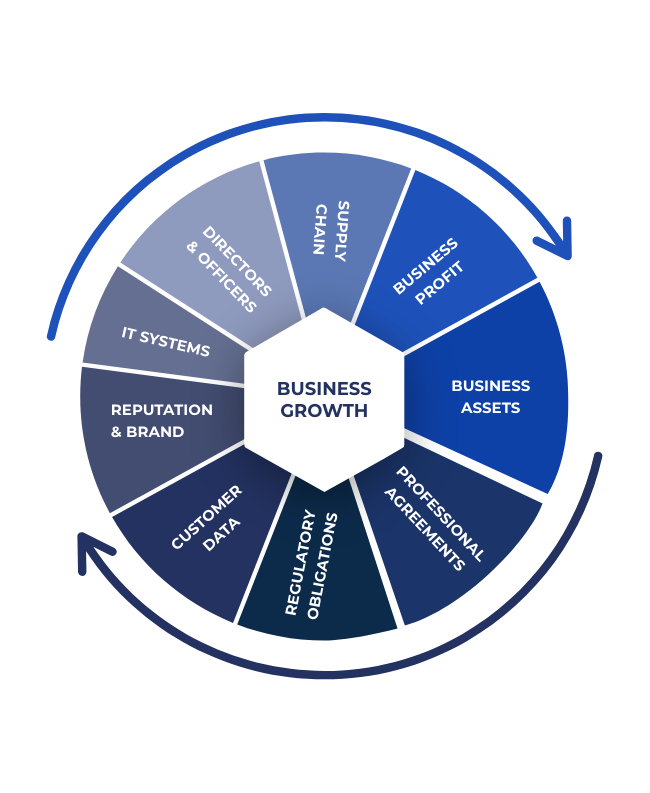

Aspect SME Insurance Cycle of Insurance provides a layer

of protection for your business to offset your risk and liability. The protection layers ensures that your insurances policies have your assets, data, customer relationships, professional contracts and directors and officers covered for any risk event that may hurt the sustainability and profit of your business. Aspect SME Insurance Cycle of Insurance ensures you meet your two critical business goals

– Continuity and Trust.

Acting for an ecommerce online business with a $5 million turnover, we identified a huge cyber risk exposure. We then organised an appropriate policy for them. Just 15 days later, they experienced a massive cybercrime incident which cost the business $150,000 . A hacker had changed the bank account details on an invoice they had sent, and the client had subsequently paid the hacker rather than our client. Fortunately for our client, this was entirely covered by the policy that we had just put in place.

We consolidated the insurance across a medical practice’s multi-site buildings to one business insurance policy including all sites, saving the client thousands of dollars.

We found $5,000 per year in policy costs for a client needing a management liability policy. We have relationships with a large range of insurers and understand the motivators and risk appetite of each different potential insurer. This means we can match the right insurer with each type of business and risk. The choice of insurer to go to for each type of risk can make an enormous difference in cost and value for our clients.

We provided coverage for a medical centre to include Telehealth in their Cyber policy and ensured the Directors’ liability related to COVID-19 vaccine roll-out scenarios was covered in their Management Liability policy. The client was happy as they were uncertain about emergent risks and glad to have adequate cover.

Don’t wait for a catastrophic event

Got some questions?

This is a 4-step process:

Aspect SME Insurance Pty Ltd ATF Aspect SME Insurance Corporate Authorised Representative No. 1294262 |ABN: 99 761 859 685 ACN: 653 626 852 | Authorised Representatives of: Community Broker Network Pty Ltd (the Licensee). Please refer to Financial Services Guide. ABN: 60 096 916 184 | ACN: 096 916 184 I AFSL 233750 | Privacy Policy | Complaints & Disputes